The 15-Second Trick For Guided Wealth Management

The 15-Second Trick For Guided Wealth Management

Blog Article

Guided Wealth Management for Beginners

Table of ContentsIndicators on Guided Wealth Management You Should KnowThe Best Strategy To Use For Guided Wealth ManagementSome Known Facts About Guided Wealth Management.Guided Wealth Management Fundamentals ExplainedThe Guided Wealth Management Diaries

The consultant will set up a possession allowance that fits both your risk resistance and risk capability. Asset allocation is merely a rubric to establish what portion of your complete monetary profile will be distributed throughout various property classes.

The ordinary base salary of an economic consultant, according to Certainly as of June 2024. Note this does not consist of an estimated $17,800 of yearly payment. Any individual can collaborate with a monetary advisor at any type of age and at any phase of life. financial advisor north brisbane. You do not have to have a high net worth; you just need to find an expert suited to your circumstance.

The Best Strategy To Use For Guided Wealth Management

If you can not manage such aid, the Financial Preparation Organization might have the ability to assist with pro bono volunteer help. Financial consultants help the customer, not the company that employs them. They need to be responsive, ready to explain economic concepts, and keep the customer's best interest at heart. If not, you should search for a new expert.

A consultant can suggest feasible enhancements to your plan that could assist you achieve your objectives a lot more efficiently. If you do not have the time or rate of interest to handle your finances, that's an additional great reason to hire an economic consultant. Those are some basic reasons you may need an expert's professional aid.

Try to find a consultant that concentrates on informing. A good economic consultant shouldn't just offer their services, however supply you with the tools and resources to end up being monetarily savvy and independent, so you can make educated choices by yourself. Seek a consultant that is informed and knowledgeable. You desire a consultant that remains on top of the financial range and updates in any area and who can answer your financial inquiries about a myriad of subjects.

Guided Wealth Management for Dummies

Others, such as qualified economic organizers(CFPs), currently adhered to this requirement. Under the suitability requirement, financial experts usually function on compensation for the items they sell to customers.

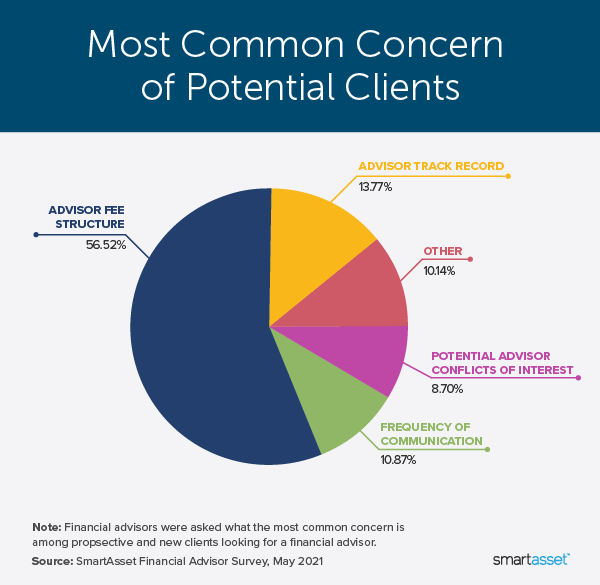

Some consultants might provide lower prices to assist customers who are just getting begun with monetary planning and can not manage a high month-to-month price. Commonly, a financial consultant will use a free, preliminary assessment.

A fee-based economic advisor is not the same as a fee-only monetary expert. A fee-based expert may make a charge for developing a monetary prepare for you, while additionally making a payment for selling you a specific insurance coverage item or investment. A fee-only financial consultant earns no compensations. The Securities and Exchange Compensation (SEC) suggested its own fiduciary guideline called Regulation Benefit in April 2018.

The 8-Second Trick For Guided Wealth Management

Robo-advisors don't need you to have much cash to begin, and they set you back less than human monetary advisors. Examples consist of Betterment and Wealthfront. These solutions can save you time and potentially money also. However, a robo-advisor can not consult with you about the most effective method to leave financial obligation or fund your child's education.

An advisor can help you figure out your savings, how to build for retirement, help with estate planning, and others. Financial advisors can be paid in a number of ways.

How Guided Wealth Management can Save You Time, Stress, and Money.

Along with the commonly tough emotional ups and downs of separation, both partners will certainly have to deal with essential economic considerations. You might very well need to transform your monetary approach to keep your objectives on track, Lawrence says.

An abrupt increase of cash or possessions raises immediate questions regarding what to do with it. "A monetary consultant can help you think via the means you could put that cash to function towards your individual other and financial goals," Lawrence states. You'll wish to think regarding just how much could most likely to paying down existing financial debt and just how much you could consider investing to go after a much more protected future.

Report this page